Describe Accounting Concepts Useful in Classifying Costs

According to the Chartered Institute of Management Accountants cost is the amount of expenditure actual or notional incurred on or attributable to a specified thing or activity Similarly according to Anthony and Wilsch cost is a measurement in monetary terms of the amount of resources used for some purposes. Classification of Costs 1 Classification by Nature.

Meaning Of Accounting Services Accounting Services Accounting Bookkeeping And Accounting

Determining the costs of an organizations products and services.

. The format of the Cost Sheet. Concept of Cost 2. Adria Lopez owner of Success Systems decides to diversify her business by also manufacturing computer workstation furniture.

Effective Cost Control 3. Costs can be classified basis various accounting bases viz. Proper Absorption of Overheads 7.

Quick CheckAnswers p. Cost classification is the logical process of categorising the different costs involved in a business process according to their type nature frequency and other features to fulfil accounting objectives and facilitate economic analysis. Different types of costs have differing characteristics.

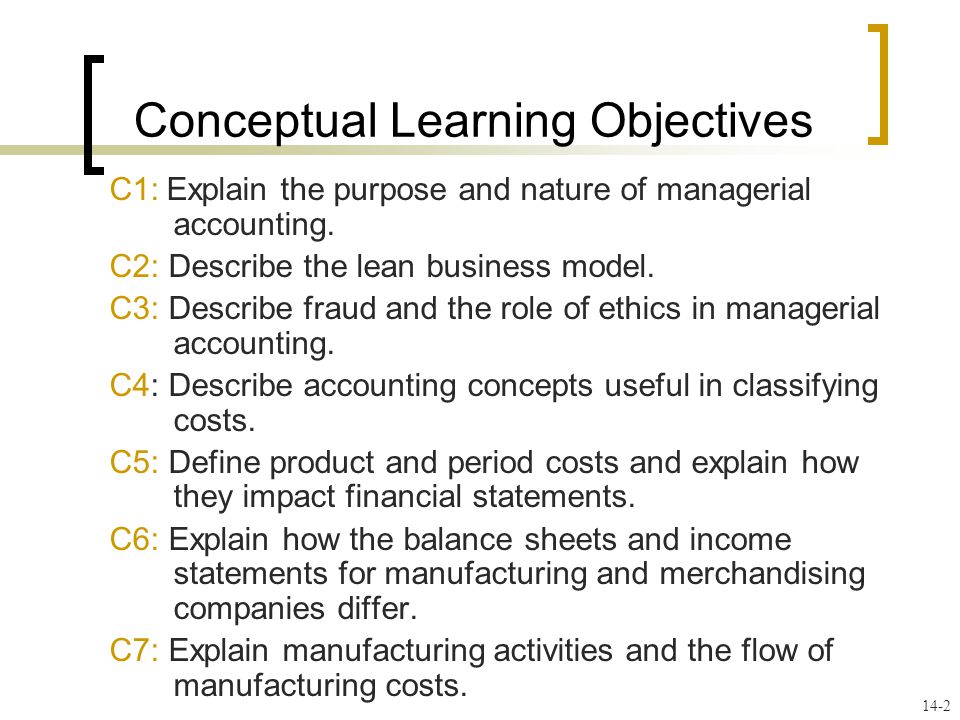

This is the analytical classification of costs. Relevant cost - cost that will differ under alternative courses of action. 14 C2 Describe accounting concepts useful in classifying costs.

Cost refers the monetary measure of the amount of resources given up or used for some specified purpose. This article throws light upon the top seven advantages of classifying cost into fixed and variable cost. Comparing actual results to planned results.

Start your trial now. Cost refers to the value sacrificed with the aim of gaining something in return. A cost can be classified in more than one way depending on the purpose for which the cost is being determined.

Standard cost - predetermined cost based on some reasonable basis such as past experiences budgeted amounts industry standards etc. A By element - The. Here the costs are divided as they are allocated to different functions in the company like Production costs Commercial costs Administration Costs Distribution Costs Distribution Costs Distribution cost is the total of all expenses incurred by the producer to make possible the delivery of the product from its location to the location of the end customer.

Expenses are assigned to the departments. Revenue expenses relate to current accounting period. 14P2 Prepare a manufacturing statement and explain its purpose and links to financial statements.

A fixed cost such as rent does not change in lock step with the level of activity. These can be classified as follows. Let us divide as per their natures.

Out of pocket and 5 functionproduct vs. Cost object which is a product process department or customer to which costs are assigned. Variable 2 traceabilitydirect vs.

Variable 2 direct vs. Marginal Costing and Break-Even Analysis 5. This information is used for break even analysis.

So basically there are three broad categories as per this classification namely Labor Cost Materials Cost and Expenses. Capital expenditures are the benefits beyond accounting period. Product Costs drop item here Classification of costs as direct or indirect.

By Element by Functions by variability or behaviour by controllability by normality by Costs for Managerial Decision making etc. Uncontrollable 4 relevancesunk vs. Indirect 3 controllabilitycontrollable vs.

2 By Functions. Cost classification can be done in various ways depending on its nature and specific purpose. These heads make it easier to classify the costs in a cost sheet.

An organization incurs many different types of costs that are classified differently de pending on management needs different costs for different purposes. Fixation of Selling Prices 4. We can classify costs as 1 fixed vs.

Fixed assets come under category of capital expenditure and maintenance of assets comes under revenue expenditure category. These classifications help us understand cost patterns analyze performance and plan operations. Expenses are separated into variable and fixed cost classifications and then variable costs are subtracted from revenues to arrive at a companys contribution margin.

C2 Describe accounting concepts useful in classifying costs. Describe accounting concepts useful in classifying costs. Indirect and 3 product vs.

Business Accounting QA Library Describe accounting concepts useful in classifying costs. Therefore if a balance sheet shows an asset at a certain value it should be assumed that this is its cost unless it is categorically stated otherwise. Fixed Variable and Mixed Costs.

There are various types of costs classified into logical groupings. Consequently when reviewing a business case to determine which path to take it is useful to understand the following cost concepts. Conversely a variable cost such as direct materials will.

These groups are such that every item of cost can be classified. Is the process of setting goals and making plans to achieve them. The capital expenditure and revenue expenditure are classified under it.

Describe accounting concepts useful in classifying costs We can classify costs on the basis of their 1 behaviorfixed vs. Are traceable to a single cost object. Cost is a foregoing measured in monetary terms incurred or potentially to be incurred to achieve a specific objective American Accounting Association.

Several types of cost classifications are noted below. The cost concept of accounting states that all acquisitions of items eg assets or items needed for expending should be recorded and retained in books at cost. First week only 499.

The actual costs incurred are compared to standard costs. In other words these costs refer to those that will affect a decision. Types of Cost Classifications.

Solution for Describe accounting concepts useful in classifying costs. We can classify costs on the basis of their 1 behavior 2 traceability 3 controllability 4 relevance and 5 function. Behavior drop item hore These include direct materials direct labor and indirect manufacturing costs called overhead costs.

Describe accounting concepts useful in classifying costs. These classifications of costs make the cost information meaningful. Period Costs drop item here Classification of costs as variable or fixed.

These include selling and general administrative expenses. 14-The purpose of managerial accounting is to provide useful information to aid in. Explain the roles and ethics of managerial accounting.

It is the value the goods or services expended to obtain current or future benefits. McGraw-Hill Education A cost is often traced to a. Fixed and Variable Costs.

Managerial Accounting Concepts And Principles Ppt Download

Cost Accounting Definition Introduction To Cost Accounting Hs Tutorial

Understanding Income Statements Income Statement Understanding Financial Statement

What Is Accounting In 2022 Accounting Accounting Principles Accounting Jobs

What Is Accounting In 2022 Accounting Accounting Principles Accounting Jobs

Accounting And Finance For Managers Accounting And Finance Financial Analysis Accounting

What Is Cost Concept Cost Concept Of Accounting Lisbdnet Com

C2 1 Learning Objectives 1 Usefulness Of An Account 2 Characteristics Of An Account 3 Analyzing And Summarizi Learning Objectives Financial Analysis Learning

10 Tips To Get The Most Out Of Your Accounting Erp Software Pastel Accounting Accounting Solutions

C2 1 Learning Objectives 1 Usefulness Of An Account 2 Characteristics Of An Account 3 Analyzing And Summarizi Learning Objectives Financial Analysis Learning

Types Of Accounting Accounting Bookkeeping Business Learn Accounting

Greenfield Investment Strategy Meaning Advantages Disadvantages Examples And More Investing Accounting And Finance Financial Management

Greenfield Investment Strategy Meaning Advantages Disadvantages Examples And More Investing Accounting And Finance Financial Management

Accounting Vs Finance Accounting And Finance Accounting Jobs Accounting

Tips To Find Best Accounting Software Financial Statement Accounting Services Accounting Software

C2 1 Learning Objectives 1 Usefulness Of An Account 2 Characteristics Of An Account 3 Analyzing And Summarizi Learning Objectives Financial Analysis Learning

Chapter 1 Accounting Principles And Concepts

Types Of Accounting Accounting Bookkeeping Business Learn Accounting

Comments

Post a Comment